Forex Trade for the Beginner What exactly is Forex Trading?

Forex is a abbreviated version of Foreign exchange, and it refers to trading one currency against another.

For instance:

If you travel to Malaysia to enjoy a vacation You’ll be able to sell Singapore Dollars to Malaysian Ringgit.

And, unlike the Stock market which is traded on a central exchange however, Forex market is a centralized exchange. Forex marketplace is traded through a counter. It’s also connected electronically between brokers and banks.

Then you’re likely to ask:

“Who are the biggest players in the Forex market?”

The banks, of course, since they are market makers.

It is followed by companies that invest in Forex to protect their positions.

Then, there are those (like me and you) who shop, speculate, online, or go on trips overseas.

Next…

What’s the benefits in Forex Trading?

We’ll now look at a few of the major advantages Forex Trading offers that you cannot find in other places…

Highly liquid Based on the Bank of International Settlements (BIS), Forex is the most important market in the world with over $5,000,000,000,000 of transactions each day. This is Trillion with an “T” This means you are able to enter and exit positions with ease and minimal slippage.

The entry barrier is low The majority of Forex brokers allow the opening of accounts for as little as $100.

Greater risk-management It is possible to trade micro lots, which allows the trader to more effectively manage risk. In contrast to Stocks for instance, the Forex market is not prone to gaps, which means you’ll seldom lose more than you intended to.

Trade whenever you like It is possible to trade anytime you want. Forex market is available 24/5. This means that you can make your trades from Monday at 5 pm EST until the Friday at 4 pm EST (depending on daylight time and daylight savings).

Low cost for transactions In contrast to the stock market, brokers generally don’t charge you for transactions. Only pay for the spread.

What is an exchange rate?

In Forex You’re working with pairs of currencies and not just one currency.

For instance:

EUR/USD: You can exchange Euro in exchange for US Dollar. US Dollar.

EUR/JPY: You can exchange Euro to the Japanese Yen.

USD/AUD: You exchange Australian Dollar to US Dollar.

Here are the top 6 currencies which are traded most frequently and have the most liquidity:

- EUR/USD

- GBP/USD

- AUD/USD

- NZD/USD

- USD/CAD

- USD/JPY

Let’s continue…

Forex trading for Beginners: How to understand the Forex currency pair with ease even when you’re not an expert in trading.

There are probably numbers that look like this…

EUR/USD 1.1792

GBP/USD 1.5255

USD/JPY 113.22

And you’re thinking…

“What the heck do these numbers mean?”

Well, let me explain…

For instance:

If you find EUR/USD 1.1792 that means that 1 euro is equivalent to $1.1792 US Dollars.

When you find GBP/USD 1.5255 this means that 1.25 British Pound equals $1.5255 US Dollars.

If you find USD/JPY 113.22 This means that one US dollars is equivalent to $113.22 JPY.

Do you think it makes sense?

Good. Let’s go one step higher…

What is pip?

Here’s the deal…

A Forex currency can be traded in units known as pip (price points of interest), which are the lowest value of an exchange.

The majority of Forex pairs are listed in the 4 fourth decimal place, with the exception for JPY pairs which are listed in the 2 2nd decimal spot.

That means that for each 0.0001 fluctuation in prices it is a one pip change.

In the case of JPY pairs, each 0.01 variation in the price it is a move of 1 pip.

Example 1:

If EUR/USD is being traded at 1.1802 and an hour later, it’s trading at 1.1807.

How much did the cost rise?

5 pips.

Example 2:

If USD/JPY is currently trading at 120.55 one hour later, the price is 120.15.

What was the cost? How much did it drop?

40 pips.

Then, there’s one final thing you should be aware of when reading the language of a exchange rate…

How do I know the definition of the spread?

Spread is the amount that differs between Bid and the Ask.

You’re probably thinking:

“What is the Bid and Ask?”

Good question.

A Bid is the value you are able to sell your house for today (always the lowest value).

This is the cost that you can get today (always the highest price).

If you can see something similar to EUR/USD trading at 1.1551/1.1552.

If you wish to sell USD/EUR in the near future, you’ll be able to sell at 1.1551.

If you are looking to purchase USD/EUR now, you can purchase at 1.1552.

This is the amount your broker earns on behalf of you (think that it’s an expense for transactions).

Now…

If you’re just beginning to learn about trading, this may appear to be an overwhelming chaos.

Since this is what I felt like when I began Forex trading. However, I assure you that when it gets time it will all be clear.

Let’s continue…

Forex trading for beginners: How to read the Forex currency pair like a pro , even when you’re not an expert in trading.

There are probably numbers that look like this…

EUR/USD 1.1792

GBP/USD 1.5255

USD/JPY 113.22

And you’re thinking…

“What the heck do these numbers mean?”

Well, let me explain…

For instance:

If you find EUR/USD 1.1792 this means that one Euro equals $1.1792 US Dollars.

When you find GBP/USD 1.5255 this means that one British Pound will be worth $1.5255 US Dollars.

If you find USD/JPY 113.22 It means that 1 US dollars is equivalent to $113.22 JPY.

Is it logical?

Good. Let’s move a step higher…

What is pip?

Here’s the truth…

A Forex currency is a unit of measurement known as pip (price points of interest) that is lowest value of an exchange.

The majority of Forex pairs are listed on the fourth fourth decimal point, except for JPY pairs that are quoted on the 2 2nd decimal spot.

That means that for each 0.0001 price change, it is a one pip change.

When it comes to JPY pairs, for every 0.01 changes in value it is a move of 1 pip.

Example 1:

If the EUR/USD pair is in trading, it’s at 1.1802 and one hour later, it’s trading at 1.1807.

What was the cost rise?

5 pips.

Example 2:

If USD/JPY is currently trading at 120.55 and one hour later they’re trading around 120.15.

What did the price decline?

40 pips.

There’s one more thing you need to be aware of when studying the language of a exchange rate…

What’s the definition of the spread?

It is the spread between Bid and the Ask.

You’re probably asking:

“What is the Bid and Ask?”

Good question.

A Bid is the value you are able to sell your house for in the present (always the less expensive value).

It is the cost you can purchase today (always the highest price).

If you can see an exchange rate that is similar to EUR/USD, it’s likely to be at 1.1551/1.1552.

If you wish to sell USD/EUR right in the near future, you’ll be able to sell at 1.1551.

If you wish to buy EUR/USD right now, you’ll purchase it at 1.1552.

This is the amount your broker earns by selling your information (think about it in terms of an expense for transactions).

Now…

If you’re just beginning to learn about trading, this may appear like something to you.

Since this is the way I felt when I began Forex trading. However, trust me when I say that when it gets time it will all be clear.

Let’s continue…

Forex Trading to Beginners What are the various Forex session for trading?

The Forex market is trading 24/7, 5.5 days a week.

It begins by it being the Syndey session, then the London session, and the New York session, and returning in that Syndey session.

If you’re using (GMT + 8) These are the times for the start and the end of every period…

If you’re interested in knowing when the market is open in your local time zone, you can utilize an application such as forexmarkethours.

Now…

It is important to understand there aren’t all trade sessions the same.

In terms of volatile times In terms of volatility, the London time is by far the most turbulent then New York, and then Asian.

If you’re trading for a short time it is essential to trade during on the London session during the time when the market is most volatile because you have a higher chances of earning profits.

Think about it…

If the market isn’t moving, it’s difficult to profit from it . It’s similar to squeezing water from the rock.

Right?

What’s the various kinds of orders? And how do you use them properly?

Typically, there are four commonly used order types:

- Market Order

- Limit Order

- Stop Order

- Stop Loss Order

Let me explain…

Market Order

Market orders get you into a trading contract right now, at the current price.

This is a method to use when you are absolutely required to go to market and you’re prepared to spend whatever price is currently.

This type of order is typically utilized by traders with a longer time frame since they’d prefer to pay a premium and enter the market today rather than miss a possible movement.

Pros You’re certain that you’ll be in the business.

Pros Pay a fee to have this assurance.

Limit Order

A limit order allows you to get into a transaction only if the market is at the price you want.

For instance:

If Apple trades at $100, you can set the buy limit at $95. You’ll only be full when Apple trades at $95, or else you won’t be trading.

Here are two diagrams to illustrate my point:

Buy Limit Order

The decision to enter into a long-term position is only when the market is trading at a level that is close to your preferred price.

Sell Limit Order

The short-term position will be entered only when the market is trading sufficiently high to the desired price.

This kind of trade is often employed by swing or short-term traders as they wish to obtain the highest possible entry price , as it increases the risk-to-reward ratio.

Advantages – You can enter your trades at an “cheaper” price.

Cons 1.) It is possible that you not see the trend. 2.) You’re betting against current trend.

Stop Order

Stop orders let you into a market only if the market is moving towards your favor (the opposite of the limit order).

For instance:

When Google trades at 100, you put a buy-stop at $110. This means that you’ll only be full Google trades above $110 or else you won’t be trading.

Let me explain:

Buy Stop Order

The long position will be entered only when the market is trading at a level that is sufficient to create an entry.

Sell Stop Order

Short positions are entered only when the market is trading at a level that is low enough to create an entry.

This type of order is utilized by traders who want to breakout because they want to make their trades more profitable by gaining the momentum.

Advantages – You make your trades using momentum.

Cons This could have been a fake breakout, and you’re short in the upper levels (or short at the lows).

Stop Loss Order

Now…

Contrary to earlier forms of orders (which can put you in the trade) Stop loss order lets you get out of the deal if the price is swaying against you.

This is a crucial rule you should be aware of because it helps you avoid damaging your trading account.

Here’s how it is done…

If you are in a long-term position your Stop Loss (red crossed line) is always below the price of entry (green dotted line). )…

In a short-term position your Stop Loss (red crossed line) will always be higher than the price of entry (green dotted line). )…

Pros The Pros includes”damage” to your account “damage” done to your account, so that you are able to fight for another day.

Cons You could be blocked from trading in the first place (but it’s better than blowing up your complete account).

If you’re interested to know how to set the proper stop loss, you can to this video tutorial…

Forex Trade for Beginners What is the best way to trade Forex with the help of Fundamental Analysis

You might be thinking:

“What is Fundamental Analysis?”

Fundamental Analysis considers information like political and economic information as they affect the strength or weakness of a currency.

There’s a lot fundamental information released each day. As trader, you have to discern the important ones and ignore the rest.

Right now this is a list of the most important things you must be aware of.

- Non-Farm Payrolls (NFP)

- Federal Open Market Committee meeting (FOMC)

- European Central Bank meeting (ECB)

Let me explain…

Non-Farm Payrolls (NFP) – USD

NFP is held on the 1st Friday of every month.

It demonstrates the power of the US economy based on the level of consumer spending and the creation of jobs.

Federal Open Market Committee (FOMC)

The FOMC is the US central bank.

The meeting will discuss how the US economy is performing and to determine if plans are in place to increase or decrease the rate of interest.

Euro Central Bank (ECB)

The ECB is the central bank of countries within Europe which use the Euro as a currency.

The meeting will discuss how the Eurozone is doing , and also to indicate whether plans are in place to increase or decrease interest rates.

The Pro-Tip Pro Tip: Visit Forex Factory and go through their calendar of news.

The ones that are marked with “Red” are usually important and are worth keeping an eye on.

Let me explain:

Let’s continue…

Forex trading for Beginners What is the best way to trade Forex with the help of Technical Analysis

In contrast to Fundamental Analysis which uses “concrete” data, Technical Analysis relies on volume and price.

In addition, you can use mathematical equations for the price (or volume) that result in indicators for trading (that you can see on a majority of trading platforms).

The premise of the technical analysis is that all information about markets is captured in price so that’s the only thing you require for trading the markets.

Here are some of the most common tools for tools for technical Analysis tools:

- Support and Resistance

- Moving average indicator

- Candlestick chart

Let me explain…

How to use Support and Resistance

Here’s the definition for Support as well as resistance…

Support An area on the chart that indicates the possibility of buying pressure that could drive price up.

Resistance A region in the chart that shows the possibility of selling pressure pushing price lower.

An example:

You’re probably asking:

“What is the use of Support and Resistance?”

It lets you time the market and find a good entry point.

How do you use the indicator of Moving Average indicator

Moving Average Moving Average is an indicator that “smooth out” past prices and appears as an arc across your chart.

There are a variety of methods of calculating Moving Average, however it doesn’t matter which method you employ because the idea is what counts.

This is why it’s impossible to figure out what is the most effective moving average because it’s not even there.

It’s far more crucial to understand how to utilize the moving average properly.

For instance, you could employ the Moving Average to:

- Determine what direction is trending.

- Find out the strengths of the trend

- Better time your entries

- Set your stop loss

- Trail your stop loss

However, it’s not within the subject matter of this piece to dive in the details of how to utilize Moving Average indicator. Moving Average indicator.

Therefore… If you’re interested in learning more, you should and read the Moving Average Trading Strategy Guide (you’ll not be dissatisfied).

Moving forward…

Chart of Candlesticks

There are many methods to show the prices of your charts.

For instance:

You can make use of charts for bar graphs, Renko chart, Line chart, Candlestick chart, and others.

In this article I’ll go over what I call the Candlestick chart since it’s one of the most used methods.

What is an Candlestick?

A Candlestick displays the open high, low, and close of your chart.

It’s a bit like this:

But wait, there’s more.

You can utilize this information to develop various Candlestick pattern (like Shooting Star, Hammer, Doji and others.) and each one has a distinct significance to them.

If you’re brand unfamiliar with Candlestick patterns, then look over the Free Candlestick Trading Course that provides you with everything you should be aware of Candlestick patterns.

Moving forward…

What Forex trading style fits you most?

Here’s the deal:

Every trader has their own trading objective.

If you’re trading to earn income, then you’ll choose either scalping or intraday trading strategy.

Trading intraday

The intraday market demands you search for profitable trading setups that allow you to trade nearly daily.

You’ll also be looking to close any open post within the next day.

You must be at ease looking at the 5-Min and 1-Hour charts for the all day long.

Scalping

The term “scalping” is basically an aspect of intraday trading.

You’ll get into and out of your trades in the span of minutes or minutes.

You’ll be taking on numerous small-scale trades that yield very little profits and losses throughout one day.

However…

If you’re trying to build your wealth, you must choose the swing or strategy of position trading.

Swing trade

Swing trading does not need you to stick to your monitor all day.

Since you’ll be trying to take advantage of an opportunity to profit from a market swing and be in position for a couple of days or perhaps a few weeks.

There are a lot of trading opportunities on the 1-Hour to Weekly timeframes.

Trading in position

Trading in position is like swing trading.

However, you’re trying to take the majority of the trends in the market without being stuck out.

In this scenario, you could hold your post for weeks, or longer.

Moving forward…

Forex Beginning to Trade: How much amount of money will you need to get started Forex trade?

Here’s the truth:

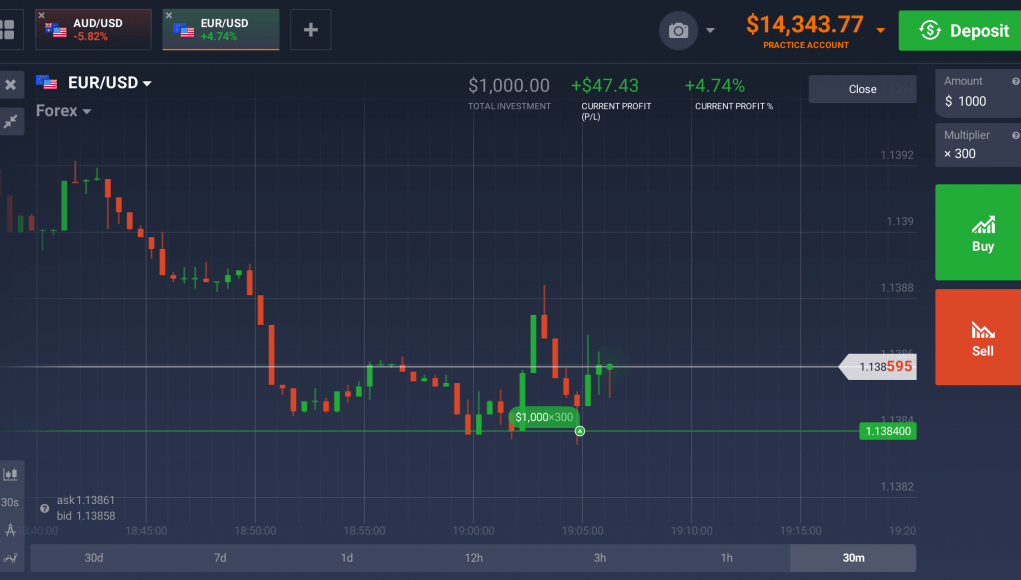

Before you start an account live I would suggest that you try a test your trading first.

You’ve probably heard other traders stating…

“Demo isn’t the real thing.”

It’s true.

Before you even begin, you need to be familiar the trading system.

This is where demo trading could be useful.

It lets you become familiar with the charting platform (like buying and sell, handle your trades, etc.) without risking any real cash.

Once you’ve mastered how to make use of an online trading system, you may want to look into funding a live trading account.