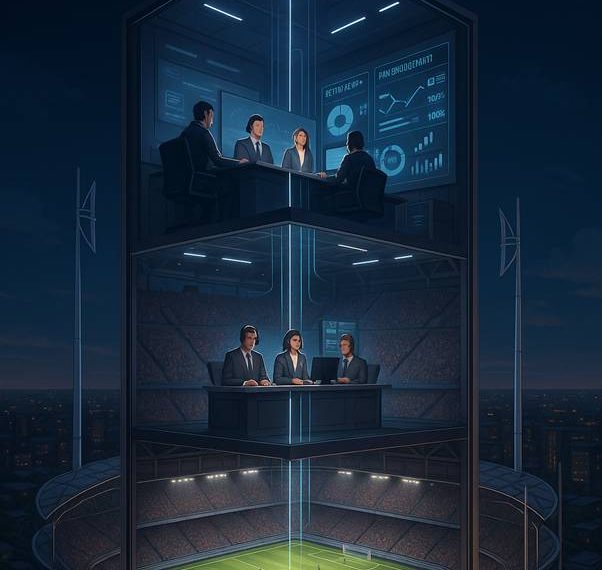

Sports leagues aren’t just hosting games anymore — they’re building comprehensive digital ecosystems. Major organizations like the NBA, NFL, and FIFA have begun acquiring broadcasting networks, betting platforms, and fan data companies that were once external partners. This shift creates a landscape where platforms like 1xbet official app now compete directly with league-owned betting services that possess exclusive data access.

Direct Control of Broadcasting Networks

The NBA made headlines in 2017 when it launched NBA TV as a fully-owned operation. With 107 regular-season games and extensive playoff coverage, they generate approximately $350 million annually while maintaining complete creative control. MLB took an even bolder approach — their MLBAM division operates streaming technology for the NFL, NHL, and WWE, bringing in nearly $1.2 billion yearly. The financial impact of league-owned sports broadcasting networks 2025 shows remarkable growth patterns across different sports organizations.

Key advantages of league-owned broadcasting:

- Complete content control and creative direction

- 100% revenue retention versus traditional 35-45% broadcast splits

- Direct access to viewer data and engagement metrics

- Ability to create exclusive programming without external approvals

- Cross-league technology licensing opportunities

Proprietary Betting Platforms and Data Exclusivity

Here’s where leagues gain their biggest competitive advantage. The MLB’s Statcast system captures ball velocity, launch angle, and defensive positioning with millisecond precision. This data directly feeds league-owned betting systems, creating wagering markets unavailable anywhere else. The Premier League’s partnership with Genius Sports goes even further — tracking everything from expected goals to individual player heat maps. Their exclusive sports data monetization for betting platforms have generated an estimated $450 million annually across major leagues.

Basketball’s NextGen Stats doesn’t just record player movements; it uses machine learning to predict optimal defensive schemes and offensive patterns. When fans place bets through league platforms, they access predictive models refined with data no external bookmaker possesses.

Fan Data Collection and Monetization

Sports organizations now operate as data businesses first, entertainment properties second. Arsenal’s mobile app tracks merchandise purchases, concession preferences, and viewing habits to create detailed fan profiles. The Chicago Bears consolidated ticketing, merchandise, and streaming into one digital ecosystem — capturing location data, spending patterns, and social media interactions.

The MLB’s Ballpark app exemplifies this strategy perfectly. Beyond basic features, it monitors which promotional offers fans engage with, preferred seating sections, and real-time stadium behavior. This intelligence drives a recommendation engine that increased average fan spending by 32% since implementation.

Financial results speak volumes. The NFL’s NFL+ streaming service projected $100 million in first-year revenue but actually generated $180 million — driven by exclusive content and personalized experiences powered by their data platform. The Premier League’s vertical integration strategy contributed approximately £600 million to 2023 revenue, representing a 45% increase from pre-integration levels.

The margin improvements are equally impressive. By eliminating intermediaries, leagues retain 70-85% of gross revenue compared to traditional 35-45% splits with external partners. The NBA’s 2023 financial statements show direct-to-consumer revenue growing 78% year-over-year, while costs increased only 22%.

External platforms haven’t remained passive. BetMGM and FanDuel secured exclusive team partnerships instead of league deals, while investing heavily in proprietary analytics to compete with league-owned data advantages. Traditional broadcasters like ESPN and Fox developed hybrid models combining conventional broadcasting with digital experiences that mirror league-owned platforms.

Smart organizations are building comprehensive digital ecosystems that capture value at every fan touchpoint. The transformation goes beyond vertical integration — it represents a fundamental shift in how sports content gets packaged, distributed, and monetized. For leagues willing to invest in technology and data infrastructure, the returns look increasingly compelling as they eliminate middlemen and establish direct relationships with their most valuable asset: the fans.